Another fantastic week of trading comes to a close, marking the end of January on a high note. I successfully profited on both my trading accounts, reinforcing the consistency and effectiveness of my trading strategy.

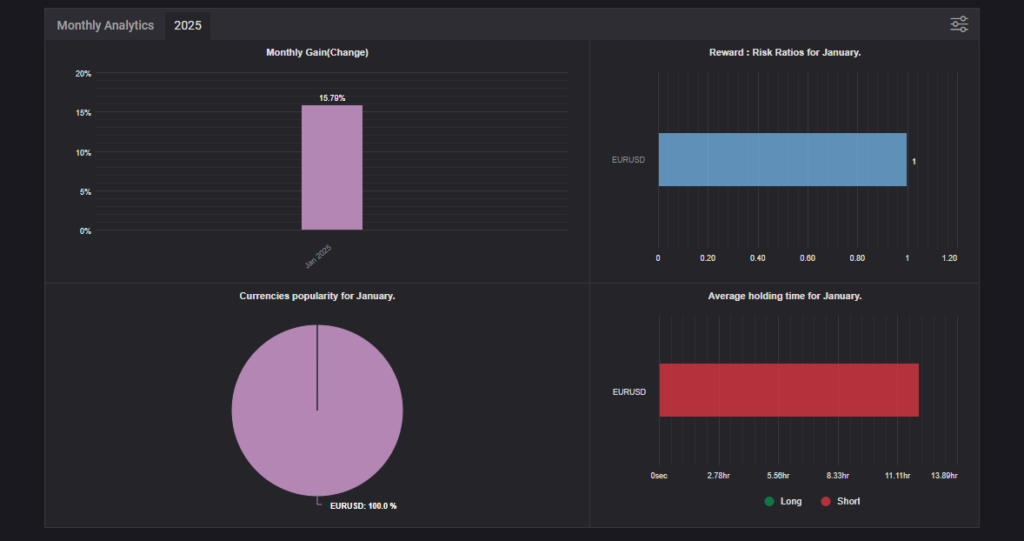

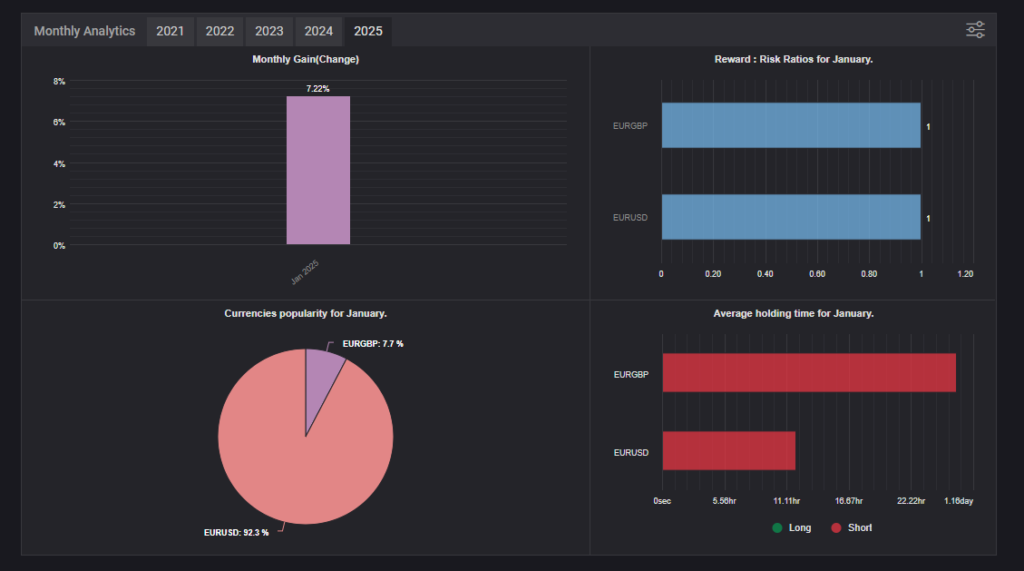

For the past couple of months, EUR/USD has been my exclusive trading instrument, and it has delivered exceptional results. Its liquidity, technical clarity, and reaction to fundamental events have made it an ideal currency pair to trade in recent times.

One of the most exciting developments last week is that I have opened a new trading account on 21st January, which will allow subscribers to copy my trades if they choose to. I know I had promised to share details on how to subscribe last week, but unfortunately, I didn’t get the chance to do so. Rest assured, I will provide a step-by-step guide soon.

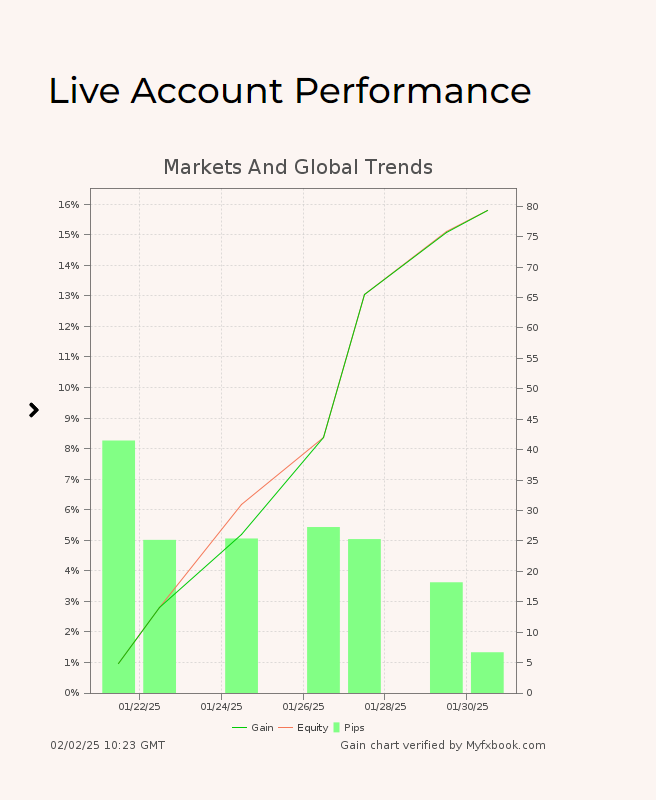

For those interested in tracking my live trades, I have posted the link to my new account on the homepage. My trading performance is now being tracked and verified by Myfxbook.com. This is not a static screenshot but a live-updating performance chart, automatically reflecting my trading results every time Myfxbook.com syncs with my account, which happens approximately every 12 hours. Moving forward, I will be placing a greater focus on trading through my new account, and eventually, I plan to transition away from my old account entirely.

Trading Summary

🔹 Successful Trades: 100% win rate last week on both the accounts

🔹 Losses: None

January 2025 Account Growth

- Existing account: 📈 7.22% growth – [Click here]

- New account (opened on 21st Jan 2025): 📈 15.79% growth – [Click here]

Market Recap – Tariffs in Focus

Last week, tariffs dominated market sentiment, causing extreme price swings and unpredictable volatility. The market transformed into a roller-coaster ride, reacting sharply to every headline and leak regarding tariffs.

At times, an unofficial report or insider leak suggested tariffs will not be severe, sending the USD lower as risk appetite improved. However, shortly after, Washington would deny or contradict the news, triggering a reversal and sending the USD higher again. This erratic movement made it challenging to establish a clear trade direction.

The biggest development? Tariffs have now been officially levied on Mexico, Canada, and China. The market’s response next week will be crucial, as traders and investors digest the economic implications.

Meanwhile, Canada wasted no time retaliating, imposing a 25% tariff in response—adding yet another layer of complexity to the geopolitical landscape.Given the market’s instability, I considered shorting EUR/GBP as a hedge against USD volatility. However, I ultimately decided against it. While EUR remains fundamentally weak, GBP still lacks strong growth signals. The latest German economic data was discouraging, and with the ECB hinting at further rate cuts, the euro remains under pressure.

Looking Ahead

With tariffs now in full effect, next week will be critical in determining whether the market has priced in these changes or if we’ll see continued uncertainty and whipsaw movements. My approach will remain cautious yet opportunistic, focusing on well-defined setups with strong risk-reward ratios.

Stay tuned for more updates, and as always—trade smart!

Disclaimer:

Trading in stocks, currencies, CFDs (Contracts for Difference), Forex, spread betting, futures, cryptocurrencies, and related financial instruments (“Trading”) involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results, and you should be aware that trading can result in substantial losses. It is essential to carefully evaluate your financial circumstances and, if necessary, consult a qualified financial advisor to determine whether trading aligns with your financial goals and risk tolerance.

Be aware that certain trading strategies, such as contingent orders (e.g., “stop-loss” or “stop-limit” orders), do not guarantee limited losses. Market conditions may render these strategies ineffective, potentially leading to losses that exceed intended limits. We also emphasize the risks and opportunities associated with leverage in trading. While leverage can amplify gains, it can equally magnify losses, resulting in significant financial impact.

Important Notice:

marketsandglobaltrends.com is not an investment advisor, The content on marketsandglobaltrends.com is provided for entertainment and informational purposes only and does not constitute professional investment advice. It should not be relied upon as a substitute for consulting a licensed financial advisor.

marketsandglobaltrends.com assumes no responsibility for financial losses, damages, or other consequences arising from trading activities. Claims for damages cannot be made against the site. Additionally, trading may have an addictive potential. If you believe you are at risk, we strongly encourage you to seek professional help.