My Trading Journey (2021-2024): Lessons, Losses, and Growth

The Beginning: A Modest Start

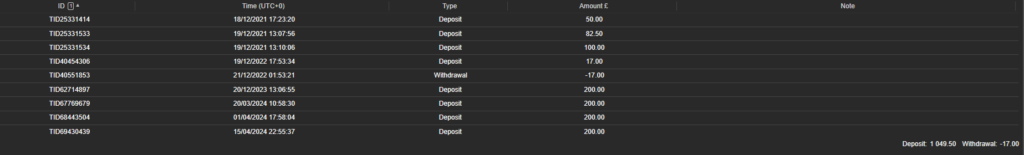

My journey into trading began in December 2021 with the account ID 11133410 on Myfxbook. I started with a small deposit of £232.50, primarily focusing on technical price levels and tracking daily support and resistance. My approach was simple—identify key levels and execute trades based on price action. The account can be accessed here.

2022: Swing Trading While Managing a Job

Throughout 2022, I was actively trading, primarily using swing trading strategies. Since I had a full-time job, I never found day trading appealing—it felt too intensive and exhaustive. Swing trading, on the other hand, provided me with the flexibility to analyse the market, place trades, and let them run over days or even

September 2022: A Hard Lesson in Fundamentals and Risk Management

Everything was going relatively smoothly until September 2022, when a financial catastrophe struck. Liz Truss and Kwasi Kwarteng released the autumn budget, triggering extreme volatility in the markets. I was short EUR/GBP, expecting the pair to decline, but instead, the British Pound skyrocketed. The market reaction was brutal, and I blew my account.

This was a turning point in my trading journey. I realized two critical lessons:

- Fundamental Analysis is Crucial – Until then, I had relied solely on technical analysis. Had I been following economic news and macro trends, I would have anticipated the risk posed by the budget announcement and avoided a catastrophic loss.

- Risk Management is Everything – I had taken excessive risk relative to my small account. This loss made me appreciate the importance of proper risk allocation, stop-loss placement, and capital preservation.

A Break from Trading (September 2022 – March 2024)

After the blow-up, I decided to step away from trading. From September 2022 to March 2024, I did not actively trade but remained engaged with the markets. I followed economic events, tracked market trends, and refined my trading strategy.

In December 2022, I deposited £17.00 to experiment with some strategies but withdrew the same amount shortly after. It wasn’t about making money—it was about testing and learning.

This period of observation and reflection solidified my belief that fundamental analysis is a key pillar of successful trading. Understanding macroeconomic policies, interest rates, and global financial events would not only protect my account but also position me for future opportunities.

March 2024: A Fresh Start with Improved Strategies

By March 2024, I was ready to return to the market with a more structured and disciplined approach. I deposited £800.00 and started trading again. This time, I combined both technical and fundamental analysis, ensuring that I was well-prepared for market shifts.

The results have been promising—by 2025, I have made a total of £278.15 in net profit. Considering my initial loss of £232.50, my total gains amount to £510.65, which represents an impressive 63.83% return.

Keeping My Trading Journey Transparent

It is important to note that Myfxbook reports my net profit as £278.15, but that is because my account history includes my previous losses. I could have opened a new account to reset my track record, but I deliberately chose to continue with 11133410 as a reminder of my past mistakes and the lessons learned.

Opening a New Account for Copy Trading (January 2025)

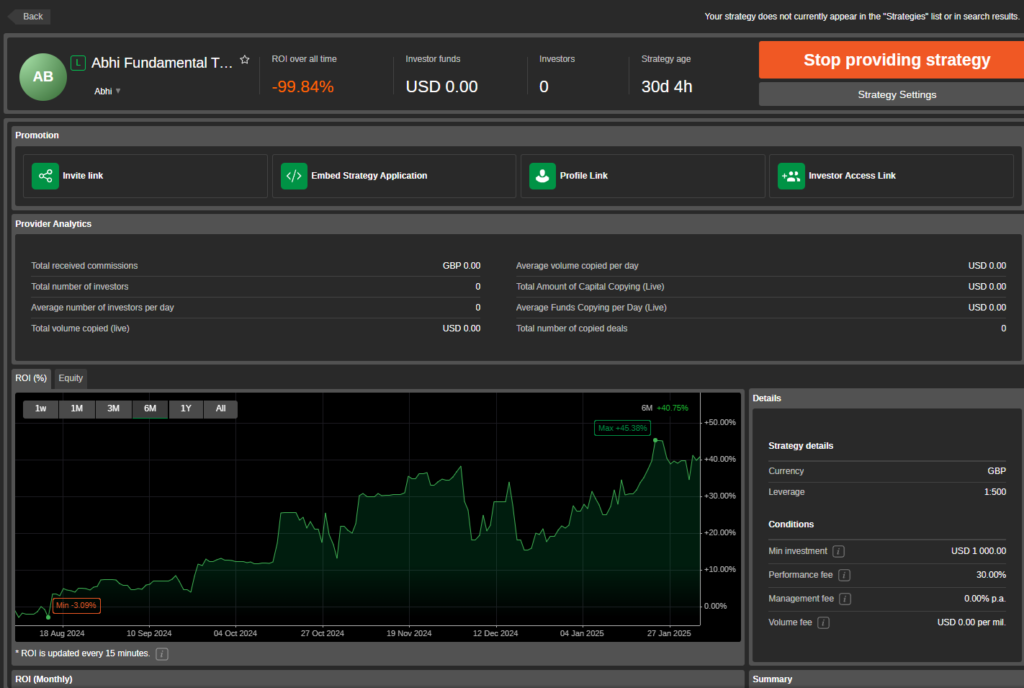

As my trading progressed, I decided to start offering copy trading services. However, due to Myfxbook’s ROI restrictions, I faced a hurdle. Since my old account (11133410) has a lifetime ROI of -99.84%, it did not qualify for cTrader’s copy trading program, which requires an ROI better than -90%.

To overcome this, I opened a new trading account (ID: 11318562) on January 21, 2025. This new account is specifically designed for copy trading services and can be accessed here.

Looking Ahead: Providing Copy Trading Services

I am now actively offering copy trading services through my new account 11318562. This marks the next phase of my trading journey—one where I aim not only to grow my own capital but also to help others benefit from my strategies and experience.

Final Thoughts

The past few years have been a rollercoaster of experiences, mistakes, and valuable lessons. My journey has reinforced key trading principles:

- Technical analysis is powerful, but fundamental analysis is essential.

- Risk management is the foundation of long-term success.

- Patience and continuous learning are more valuable than quick profits.

For those starting out, my advice is simple: Learn from my mistakes, stay disciplined, and never stop evolving as a trader.

Disclaimer:

Trading in stocks, currencies, CFDs (Contracts for Difference), Forex, spread betting, futures, cryptocurrencies, and related financial instruments (“Trading”) involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results, and you should be aware that trading can result in substantial losses. It is essential to carefully evaluate your financial circumstances and, if necessary, consult a qualified financial advisor to determine whether trading aligns with your financial goals and risk tolerance.

Be aware that certain trading strategies, such as contingent orders (e.g., “stop-loss” or “stop-limit” orders), do not guarantee limited losses. Market conditions may render these strategies ineffective, potentially leading to losses that exceed intended limits. We also emphasize the risks and opportunities associated with leverage in trading. While leverage can amplify gains, it can equally magnify losses, resulting in significant financial impact.

Important Notice:

marketsandglobaltrends.com is not an investment advisor, The content on marketsandglobaltrends.com is provided for entertainment and informational purposes only and does not constitute professional investment advice. It should not be relied upon as a substitute for consulting a licensed financial advisor.

marketsandglobaltrends.com assumes no responsibility for financial losses, damages, or other consequences arising from trading activities. Claims for damages cannot be made against the site. Additionally, trading may have an addictive potential. If you believe you are at risk, we strongly encourage you to seek professional help.