How to Copy Trades Using cTrader Copy: A Beginner’s Guide

In my previous blog post (here), I mentioned why I prefer cTrader over other platforms. In this post, I will mention how we can use cTrader Copy to copy trades. If you want to copy my trades, I will provide you with my cTrader strategy available to be copied at a 30% performance fee.

Copy trading is an excellent way to benefit from the expertise of professional traders without having to analyze the markets yourself. One of the most powerful platforms for this is cTrader Copy, a feature-rich solution that allows traders to mirror the trades of strategy providers in real-time. If you’re new to cTrader Copy, this guide will help you get started.

What is cTrader Copy?

cTrader Copy is a social trading feature within the cTrader ecosystem that enables investors (followers) to automatically copy the trades of experienced traders (strategy providers). It is an ideal solution for beginners who want to leverage professional strategies or for busy traders looking for a hands-free investment method.

Benefits of Using cTrader Copy

- Hands-free Trading – No need to analyze markets or execute trades manually.

- Access to Experienced Traders – Copy strategies from seasoned traders with a proven track record.

- Transparent Performance Metrics – View detailed statistics before choosing a strategy provider.

- Flexible Investment Options – Adjust your risk parameters and capital allocation.

How to Copy Trades on cTrader Copy

Step 1: Create a cTrader Account

If you don’t already have an account, sign up with a broker that supports cTrader. Ensure that they offer the cTrader Copy feature.

Step 2: Access cTrader Copy

Once you’re logged in, navigate to cTrader Copy from the main menu. Here, you will find a list of available strategy providers.

Step 3: Choose a Strategy Provider

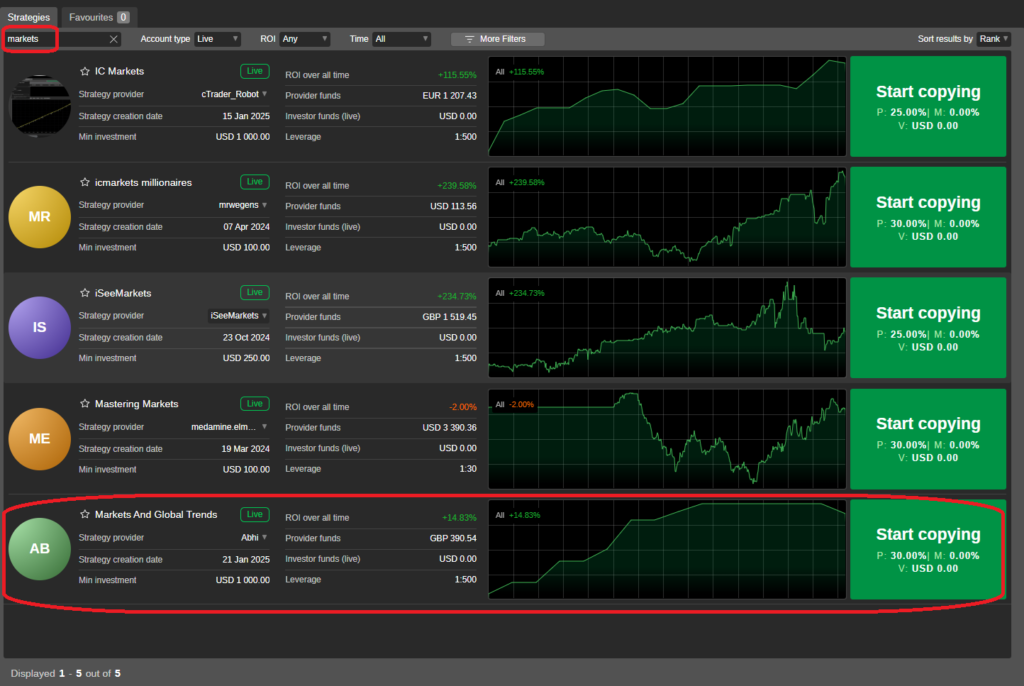

- Browse Strategies: Look through the list of available strategies.

- Analyze Performance: Each strategy provider has detailed performance metrics, including profitability, drawdown, trade history, and fees.

- Check Fees: Some strategy providers charge a performance fee or a volume-based fee.

- Read Reviews: Check feedback from other followers.

Step 4: Start Copying a Strategy

- Click on the strategy you wish to copy.

- Set the investment amount – Decide how much capital you want to allocate.

- Adjust risk management settings – Some strategies allow customization of trade sizes and risk.

- Confirm and start copying!

Step 5: Monitor Your Performance

Once you’ve started copying, regularly check the performance of your copied trades in the cTrader Copy dashboard. If needed, you can stop copying or adjust your settings.

Best Practices for cTrader Copy

- Start Small: Begin with a small investment before committing more capital.

- Diversify: Copy multiple strategies to reduce risk.

- Monitor Regularly: Even though copy trading is automated, it’s essential to check on performance periodically.

- Understand Risks: No strategy is risk-free. Be prepared for potential losses.

My Trading Strategy on cTrader Copy

I provide my trading strategy on cTrader strategy copy under the name “Markets And Global Trends”, and I charge 30% as a performance fee. If you want to set and forget for a fee, you may copy my trades and take advantage of my strategy.

Final Thoughts

cTrader Copy is a powerful tool that makes trading more accessible to beginners and busy investors. By following this guide, you can confidently start copying trades and potentially grow your portfolio with the expertise of professional traders.

Have you tried cTrader Copy? Share your experiences and tips in the comments below!

Disclaimer

I have no affiliation with cTrader or its parent company Spotware. The above is just my personal opinion on why I prefer cTrader over other platforms. I do not receive any monetary benefits from them. MT5 and MT4 are the market leaders in terms of the number of users who trade on them. Please do your own due diligence before selecting a trading platform that suits your needs.

Disclaimer:

Trading in stocks, currencies, CFDs (Contracts for Difference), Forex, spread betting, futures, cryptocurrencies, and related financial instruments (“Trading”) involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results, and you should be aware that trading can result in substantial losses. It is essential to carefully evaluate your financial circumstances and, if necessary, consult a qualified financial advisor to determine whether trading aligns with your financial goals and risk tolerance.

Be aware that certain trading strategies, such as contingent orders (e.g., “stop-loss” or “stop-limit” orders), do not guarantee limited losses. Market conditions may render these strategies ineffective, potentially leading to losses that exceed intended limits. We also emphasize the risks and opportunities associated with leverage in trading. While leverage can amplify gains, it can equally magnify losses, resulting in significant financial impact.

Important Notice:

marketsandglobaltrends.com is not an investment advisor, The content on marketsandglobaltrends.com is provided for entertainment and informational purposes only and does not constitute professional investment advice. It should not be relied upon as a substitute for consulting a licensed financial advisor.

marketsandglobaltrends.com assumes no responsibility for financial losses, damages, or other consequences arising from trading activities. Claims for damages cannot be made against the site. Additionally, trading may have an addictive potential. If you believe you are at risk, we strongly encourage you to seek professional help.