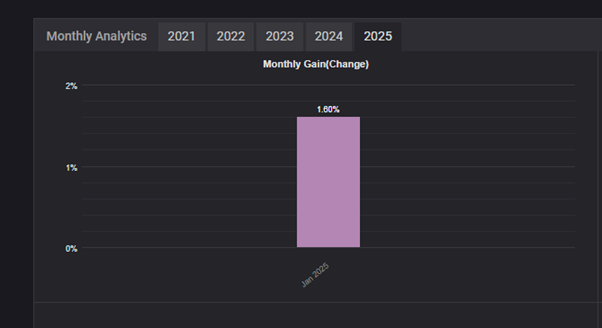

Performance Overview

As of now, my trading account has achieved a 1.6% gain in January 2025. This performance aligns with my monthly goals, and I’m satisfied with the progress so far.

Key Highlights:

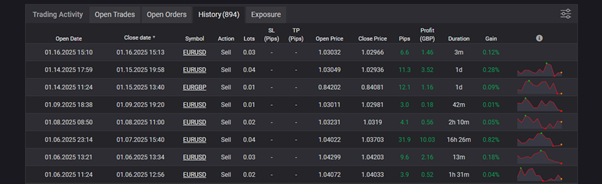

- Favourite Instrument: The EURUSD has been my preferred trading pair throughout January.

- Strategy: I have been consistently shorting the EURUSD on pullbacks, which has proven to be highly effective.

- Results:

- Successful Trades: 100%

- Losses: None

This reflects strong adherence to my trading plan and careful risk management.

Market Insights

I am closely monitoring the developments around Trump’s tariffs. These policies have been creating uncertainty in the market, but once clarity emerges, I anticipate the market’s focus will return to the Euro.

My analysis suggests that the Euro will likely remain weak for the next couple of months due to ongoing economic challenges and potential shifts in monetary policy. This outlook supports my strategy of shorting EURUSD.

Outlook and Strategy

For the rest of January, I intend to maintain a short bias on EURUSD, capitalizing on pullback opportunities. This pair will remain one of my “go-to” trades, as it aligns well with my analysis and trading style.

Additional Resources

To track my trading performance and gain more insights, you can access my trade journal on Myfxbook: Myfxbook – IC Markets

Disclaimer:

Trading in stocks, currencies, CFDs (Contracts for Difference), Forex, spread betting, futures, cryptocurrencies, and related financial instruments (“Trading”) involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results, and you should be aware that trading can result in substantial losses. It is essential to carefully evaluate your financial circumstances and, if necessary, consult a qualified financial advisor to determine whether trading aligns with your financial goals and risk tolerance.

Be aware that certain trading strategies, such as contingent orders (e.g., “stop-loss” or “stop-limit” orders), do not guarantee limited losses. Market conditions may render these strategies ineffective, potentially leading to losses that exceed intended limits. We also emphasize the risks and opportunities associated with leverage in trading. While leverage can amplify gains, it can equally magnify losses, resulting in significant financial impact.

Important Notice:

The content on marketsandglobaltrends.com is provided for entertainment and informational purposes only and does not constitute professional investment advice. It should not be relied upon as a substitute for consulting a licensed financial advisor.

marketsandglobaltrends.com assumes no responsibility for financial losses, damages, or other consequences arising from trading activities. Claims for damages cannot be made against the site. Additionally, trading may have an addictive potential. If you believe you are at risk, we strongly encourage you to seek professional help.